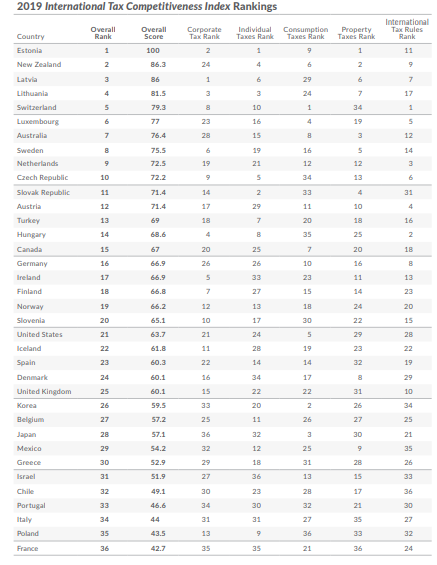

The Tax Foundation releases yearly an analysis comparing the fiscal burdens that companies and individuals bear in the 36 of the 37 OECD member countries.

In their International Tax Competitiveness Index 2019 Estonia repeated as the leader in the list, a position maintained for at least the last three years.

The reasons why this small European country deserves the honour are well explained in the report but can be condensed in the following advantages:

· Estonia’s corporate income tax system applies a 20% tax rate on distributed earnings ONLY, allowing companies to reinvest their profits tax-free.

· The 20% VAT applies to a broad base and has a low compliance burden.

· Property taxes only apply to the value of the land. Constructions pay 0% tax.

· Individual tax rates are low (top marginal Income tax rate 32.4%), and the tax code is simple to apply.

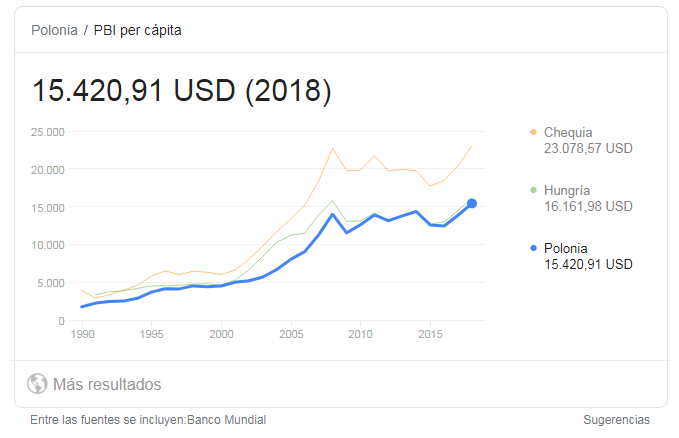

According to the 2019 Global Competitiveness Report edited by the World Economic Foundation, Estonia ranks as the 31st most competitive economy in the world but first in Public Debt Dynamics (variable 4.2). In the last ten years Estonia has grown enormously in the last 30 years, following a much better trend than most of the countries in the ancient communist block.

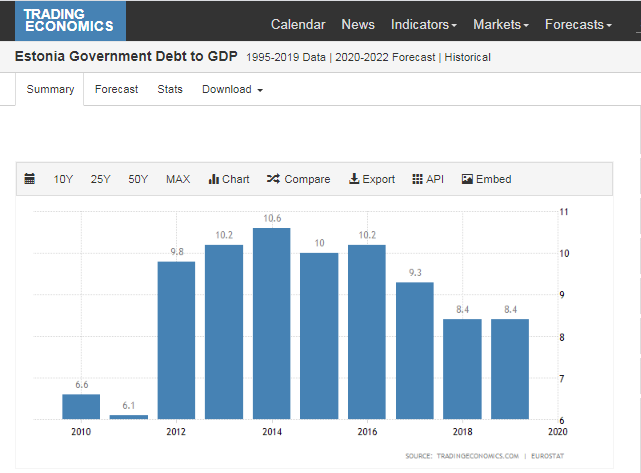

One important aspect to consider the future evolution of taxation in one country is the current situation of public debt. Public debt reflects the anticipated use of future income. Still, liabilities have to be paid back by the citizens of the country sometime in the future, either thru additional taxes or diminished public services.

Which is the public debt situation of Estonia?. See the chart:

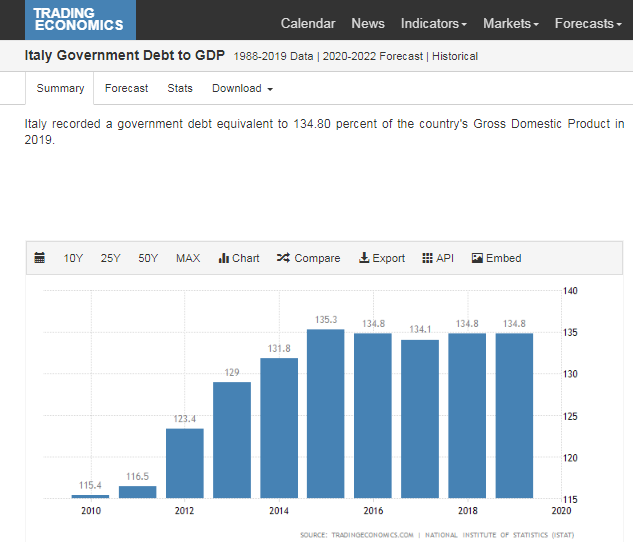

Let’s compare this with the situation of Italy, for instance, a country ranking as low as 34 in the Tax Competitiveness Index and with an overwhelming public debt:

It is easy to imagine in what country citizens and companies will suffer higher taxation rates which will become a heavy burden for anyone willing to enjoy a decent life from their work. Similar disasters to the Italian one can be observed in France, Belgium, Spain, Portugal, Greece, Lebanon, the USA,….

The payment of taxes is necessary for the normal functioning of our societies. Still, it is a legitimate question to ask why some countries need to apply such high burdens to their citizens while other countries seem to be able to cope with much less without providing lower conditions for a more than decent life quality.

Some countries appear among the first ten most competitive economies in both lists (Tax-Global), such as Switzerland (5 – 5), Sweden (8 -8) and the Netherlands (9 – 4).

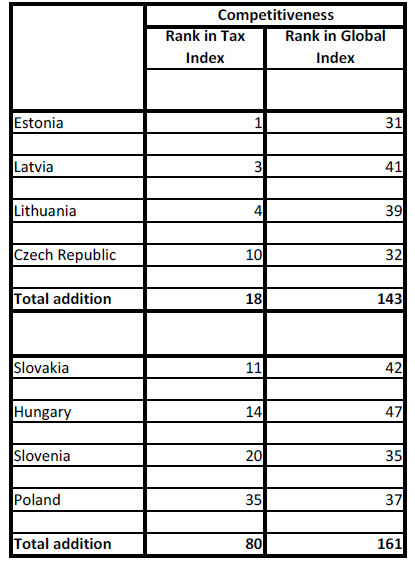

What is more, if we could compare Estonia, Latvia, Lithuania and the Czech Republic (1, 3, 4 and 10 respectively as the most tax-competitive countries in the OECD) with some other previous communists countries, we could infer that, in average, tax-competitive nations have a slight chance to be globally more competitive than their less tax-competitive peers.

The above mentioned should not imply that very tax-competitive economies will be more global-competitive countries. Thou it is not in the list because it is not an OECD member, Romania has a highly competitive tax structure (I will dedicate a post to this case) but ranks average in the global competitive index. And also, other countries that rank low in tax-competitiveness are quite high in the global competitiveness index.

Competitiveness, the quality of being wanted despite the costs, results from the interaction of multiple factors. Taxation is one of many. The correct public use of the resources can compensate for high taxes. Still, low taxation can stop a country from offering the proper environment for doing business.

In the end, it is a question of efficient or inefficient governing. Adequate management of sufficient resources in a low taxation economy is the best solution.